Home | Sustainability | Corporate Governance |

Risk Management

RISK MANAGEMENT

Risk Management Policy and Plans

The Group Management Committee embraces a top-down and cross-functional approach for purpose of evaluating and managing the Group’s risk factors.

The above functions are managed by RCL's sub-committee, namely Risk Management Committee (RMC) which now comprises five (5) members:

1. The President of the Group,

2. Executive Vice President (Business),

3. Executive Vice President (Group Finance & Accounting),

4. Vice President (IT), and

5. Vice President (RSM).

This specialised taskforce bears the responsibility of driving business results and is accountable for the associated risks.

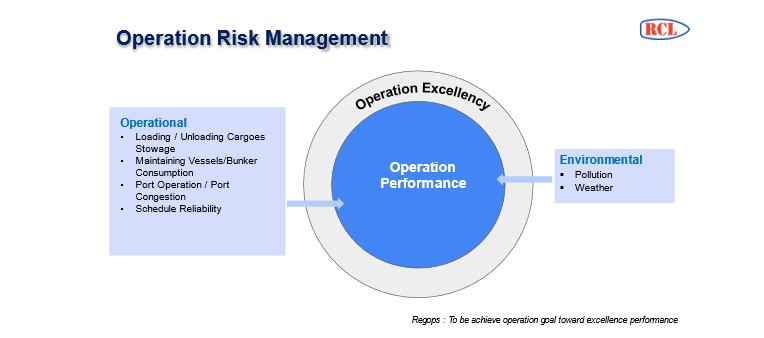

The sub-committee has identified four (4) major risk areas that may adversely affect our Group’s business and performance. They are Marketing Risk, Financial Risk, Operation Risk and IT Risk.

In 2023 RMC conducted 5 meetings to address company risks in major functions to prevent and mitigate the risks. Example of the discussion in the meetings are IT audit, IT testing, ship management, ship/port operation, business continuity plan and etc

Risk Factors

1.1 Geopolitics, economic fragmentation and less global cooperation

As we transition from the past 20-25 years where globalization was the global theme, we are now moving into another phase where geopolitics at the political, economic and social levels are now the priorities of most governments and electorate. There is less international cooperation on many issues and selective cooperation on some issues of common interest which unfortunately will result in larger fluctuations and variations in positive or negative outcomes when they do occur.

1.2 SOC business remains under pressure

With focus on cost savings and more direct calls fueled through new ship deliveries in 2024 and container terminals that can accommodate larger ships, we will see more main line operators continue to shift from third party feeder usage to their own ships for the first leg or last mile connection.

1.3 US and China rivalry continues

The US and China rivalry continues from the economic, technology, military, sphere of influence, G7 vs Global South, USA vs China, South China Sea and even at the people-to-people level where they are now restrictions placed on Chinese citizens seeking to study in certain academic fields. US and China are the number one and two largest economies in the world right now and the rivalry between them will only hurt growth prospects for the rest of the world.

1.4 Economic shift from the Trans-Atlantic to the Asia-Indian sub-continent and Middle East – Africa world

With Asia, Indian sub-continent and the Middle East enjoying higher growth and accounting for a larger percentage of global GDP, global carriers will also focus their resources and expansion into this RCL’s geography of operations. Greater competition can be expected from both regional and global operators.

1.5 Geographic concentration

RCL has expanded its business presence from the Indian sub-continent, Middle East and up to East Africa in 2023. With the new ship deliveries in 2024 also slated for the same area, the exposure will be even larger in 2024 when we employ these ships. Going forward and given a volatile world, it will be prudent to balance the concentration and avoid any over reliance on any geography for its revenue and margin generation.

1.6 New ship supply in 2024

New ship delivery in 2024 will be about 3 million TEU or about 9% more than 2023. While the new ships will mostly be concentrated in the 7,000 TEU or larger ship size, there remains a cascading of ships to our area of operation particularly from the Top 10 global operators.

1.7 2024 is year of national elections super cycle

We will see a record fifty plus elections in 2024 around the world. Some elections like those in the United States, European Union, India may have a larger impact on business in a regional or global while others may result in some smaller shockwaves that are mostly localised.

1.8 Climate change affecting container shipping

In 2023, we saw the impact of less rainfall affecting the draft in the Panama Canal. We also saw the impact of less rainfall in Europe affecting certain waterways. This impact will continue into 2024 with climate change, creating potential terminal congestion or vessel deployment or routing changes as a result.

2.1 Currency Risk

Our Group’s revenues are based on the US Dollar via an established pricing mechanism. Freight rates are quoted in US Dollars whilst freight revenues are collected either in US Dollars, or in the corresponding amount of loading port currencies. Our Group’s operating costs are predominantly in US Dollars with the balance proportionately distributed among major loading port currencies (such as Thai Baht and Singapore Dollar). While currency fluctuation had been one of the key concerns during 2023, the continuous rise of US interest rate, as a remedial instrument to curb inflation, had swung the US Dollars against the other currencies.

However, the risk from the currency fluctuation did not have a major impact on our cash flow from operations, due to the fact that our assets, for example, container vessels were bought and sold in US Dollars. Furthermore, our loan portfolios, as well as fixed assets are mainly in US Dollars denomination. With the exception of certain accounting translation effects, our Group has been able to enjoy a natural foreign exchange hedging.

2.2 Interest Rate Risk

With the direction to expand our fleet size amidst the rising interest rate environment, our Group is exposed to the interest rate risk due to the nature of the vessel financing loan requirements. With the interest rate gradually rising since the beginning of 2022, we have decided to mitigate the additional risk exposure by securing some long-term obligations into fixed interest rate.

Our Group’s total borrowings, as at year ended 2023, mostly long-term loan amounted to Baht 2.5 billion compared to that of Baht 3.0 billion at the end of year 2022. This is the outcome from our direction to reduce the interest expense. In 2023, RCL made loan prepayments to some of the loans that bore higher interest margin. As a result of which, all our loan interest rate for the outstanding amount, was fixed for year ended 2023.

On the other hand, our Group’s interest income rose alongside with the rising interest rate environment. As at year ended 2023, the Group’s interest income reached Baht540.9million compare to that of Baht116.7million in 2022.

2.3 Vessel Valuation Risk

Vessels are the Group’s key fixed assets and resources for operation. The value of vessels fluctuates according to the global economy - appreciates with the upturn and adversely drops with the downturn.

2.4 Funding Risk

The Group’s healthy financial position for the past three years resulted from the excellent operating results since early 2020 has supported the Group in upholding a strong financial position and enabling us to attain a modest cost of fund and reducing the funding risk.

3.1 Red sea crisis-global trade affected

Almost all of the world’s large shipping companies are continuing to pause shipments through the Red Sea after attacks by Houthi rebels along the crucial international trade route. Their container ships would continue to avoid the route, which is a central artery for global trade on the passage from Asia to Europe via the Suez Canal and the Mediterranean. This will have an effect on RCL’s future fleet expansion include chartering business.

As container ships are diverted around the Cape of Good Hope on the southern tip of Africa, adding thousands of miles to journeys, the disruption is driving up the cost of shipments from Asia to Europe, raising the prospect of a renewed inflation shock for the world economy.

Though there is no claims yet, but insurance cost may rise if tensions grow.

3.2 Bunker Consumption effected Carbon Intensity Indicator (CII) for old age vessels.

By the end of March 2024, the IMO Data Collection System (DCS) will publish the results of the CII rating for 2023. A vessel must plan and carry out improvement activities to get a rating of C or higher if it receives an E in any given year. If the corrective actions are not submitted for verification, the vessel cannot obtain the Statement of Compliance (SoC).

It is challenging to improve the CII rating from E to C, especially for older vessels. Energy-saving devices (ESD) can be installed, but different approaches must be used in combination; otherwise, converting to alternate fuels which require an investment.

3.3 Revised of IMO GHG Strategy which more stringent.

The 80th session of the IMO’s Marine Environment Protection Committee (MEPC 80) adopted a revised GHG Strategy. The revised strategy aims to significantly curb GHG emissions from international shipping.

- By 2030: Reduce GHG emissions by 20% – 30% (as against 2008 levels)

- By 2030: 5% – 10% of energy used by international shipping to come from zero or near-zero GHG emissions technologies.

- By 2040: Reduce GHG emissions by 70% – 80% (as against 2008 levels)

- ‘Close to’ 2050: Reach net-zero GHG emissions

This new strategy will impact existing ships that burn fossil fuels globally.

3.4 Shipboard Container Stowage

Stowage planning is one of major objective of container vessel operations. Risk management is to be taken into consideration whenever RCL fleet perform cargoes operation. The cargo must be stowed in such a way that the vessel will be stable and seaworthy at all time, and it must be secured in such a manner that it cannot shift if the vessel encounters terrible weather, giving due consideration to the following:

- Safety Criteria, Cargoes Securing Manual

- Stability,Trim, Stress

- Load line, Stacking weight, IMO Line of Visibility

- Reefer Containers and Other Special Units

- Sequence of Loading and Discharging

-

Hazardous Cargo as IMDG: Dangerous Goods carried on containerships shall be stowed safely. Based on this overall goal, six sub-goals are defined. Functional requirements to meet each of the six sub-goals are identified. In addition, risk-based stowage strategies are presented to satisfy the criteria provided by the functional requirements

The following subsections described the sub-goals,

- Protect Lives

- Retain Main Propulsion

- Retain Structural Integrity

- Facilitate Fire Prevention

- Facilitate Fire-fighting

- Facilitate Security

The quality of stowage operations affects the vessel’s operation performance significantly, whereby coordination and communication among our Central Stowage Planning Unit i.e. Locations, Terminals and Master of vessels must be well maintained, bearing in mind costs effectiveness and efficiency controls. Fast turnaround vessel with high port cranes productivity and shorten vessel port stay as much as possible, with a view to enable vessel to have more buffer times at sea for sailing with vessel economic speed for bunker savings, is of importance.

3.5 Port Operation Constrain

Port congestion is a significant issue in the supply chain industry which can badly affect the maritime transportation and logistics sectors. Disruptions can significantly impact delivery schedules and production cycle. Causes of port congestion maybe due to various reasons, i.e.

- Port or terminal is booked to more than its capacity

- Delays caused by bad weather which results in vessels lining up outside

- Industrial action or strikes

- Lack of port handling equipment, Slow productivity, Lack of yard space

- Pandemics like COVID-19

- Location of the port

RCL network, like R1: TAO/NGB, R3S: SIN/WSP/BTU, R3W: CCU/NSA, R4: PAT/KOS are occasionally facing congestions due to various reasons, all of which, are pushing up vessel operating costs. Operation risks and uncertain situation continue to prevail. RCL recognizes that this will indirectly lead to customers’ dissatisfaction at times and also incremental cost. For this reason, we have in placed our ongoing contingency plans to minimize vessel delay and will always apply them when necessary. We are working closely with all respective port authorities and coordinating with all parties involved to help alleviate the situation. Steps taken are for example:

- Evaluate records of daily average arrival and departure statistics of ship calls in ports.

- Planned efficiency on berth occupancy, coordinate the appropriate vessel’s ETA.

- Shorten port stay, Minimize idling time

- Sufficient stowage instruction.

- Maximize crane intensity.

Those elements been addressed with the aim of improving productivity, by assessing each procedure of port operation, identifying problems in order to make corrective actions, ensuring full co-operation and best efforts are being extended to and from all ports in our networks. Thus, resulting in optimizing the port/terminal operational efficiency.

RCL continues to develop vessel track functionality to enable customers to track in real time for predictive analysis and estimated times of arrival (ETA) via our Website. RCL will maneuver this situation as best as we can.

3.6 Schedule Integrity

Bad weather, port congestions and passageway, are the common causes of vessel delayed out of Proforma/Schedule. Schedule reliability also forms part of our risk, Overcoming and mitigating these issues would be RCL’s key success factor.

In November 2023 RCL’s reliability score reached 62.8%, with 57.8% on the average for the whole year 2023. RCL will continue do our best effort to overcome this problem.

RCL will do timely decision making relating to vessel schedule integrity, in consultation and full cooperation with alliances partners in service, to work out strategies on alternate port calls and cargoes management.

The year 2023 presented challenges for IT security, with an increase in cyber-attacks and the emergence of new technologies. The RCL IT team implemented proactive measures to mitigate risks, focusing on key areas of concern and vulnerabilities that could impact operations. This summary highlights key risks:

4.1 Cybersecurity Threats:

- Phishing: Numerous new types of phishing attacks, more complex patterns. Importantly, the targets varied with an expanded focus beyond a single target.

- Ransomware: Aligned with global statistics, the number of ransomwares captured sharply increased compared to 2022.

- Spam: In addition to phishing and ransomware, spam emerged as a significant cybersecurity threat in 2023. The RCL IT team responded by enhancing advanced detection mechanisms and protective measures to comply with IT security standards. Through the adoption of a holistic approach to cybersecurity, RCL aimed to fortify its defenses against a broad spectrum of threats, including spam attacks.

Therefore, The RCL IT team has improved advanced detection and protective to align with IT security standard compliance. In addition, we are strengthening the vulnerability assessment and patching processes.

4.2 Insider Threat:

Unintentional actions by employees can caused risk of threats that may compromise the IT security. For this reason, we conduct regular training sessions on security awareness programs for employees to build awareness and mitigate this potential threat

4.3 Technological Infrastructure:

- Outdated system: Some legacy systems were potential vulnerabilities and no longer supported by the software producer. The RCL IT must upgrade and replace the system to prevent the threat.

- Outdated firmware: Updating firmware is necessary to maintain the security of devices and systems. Addressing outdated firmware has become a key focus, ensuring that all devices are equipped with the latest security patches and improvements to mitigate vulnerabilities.

- Outdated Operating system: Representing another potential risk to IT security. RCL committed to regularly update and upgrade all systems, ensuring they run on the latest, secure operating versions. This aimed to minimize the risk of exploitation through known vulnerabilities associated with outdated operating systems.

4.4 IT Costs:

The cost, especially in terms of human resources cost has increased. The overall business has become more reliant on technology which require specialized skill. However, a shortage of specialized skill resources in the market led to a sharp increase in human resource costs. RCL is empowering our IT staff to enhance their skills and knowledge by offering support for training costs if required.

Conclusion

In conclusion, the IT risks faced by RCL in 2023 were diverse and dynamic, requiring a multifaceted and proactive risk assessment approach. To address all the key risks, RCL’s IT team demonstrated resilience and adaptability in safeguarding the organization's digital assets. The commitment to continuous improvement, adherence to IT security standards, and the empowerment of staff members with new skills positioned RCL to navigate the complexities of the evolving IT landscape in 2023 and beyond.

Authority and Responsibilities of the Risk Management Committee

The committee is entrusted with the following accountabilities:

1. Establish / review and propose the risk management policy at all levels for the Board's approval.

2. Ensure that the Group's operations are consistent with enterprise risk management framework.

3. Review risk management report; take actions to ensure that adequate and appropriate risk mitigation activities are conducted to manage risks.

4. Present the overall enterprise risk profile including the sufficiency of internal control to manage risks to the Board for periodic review and approval.

5. Advise the risk management units and improve the information system relevant to the development of risk management process.